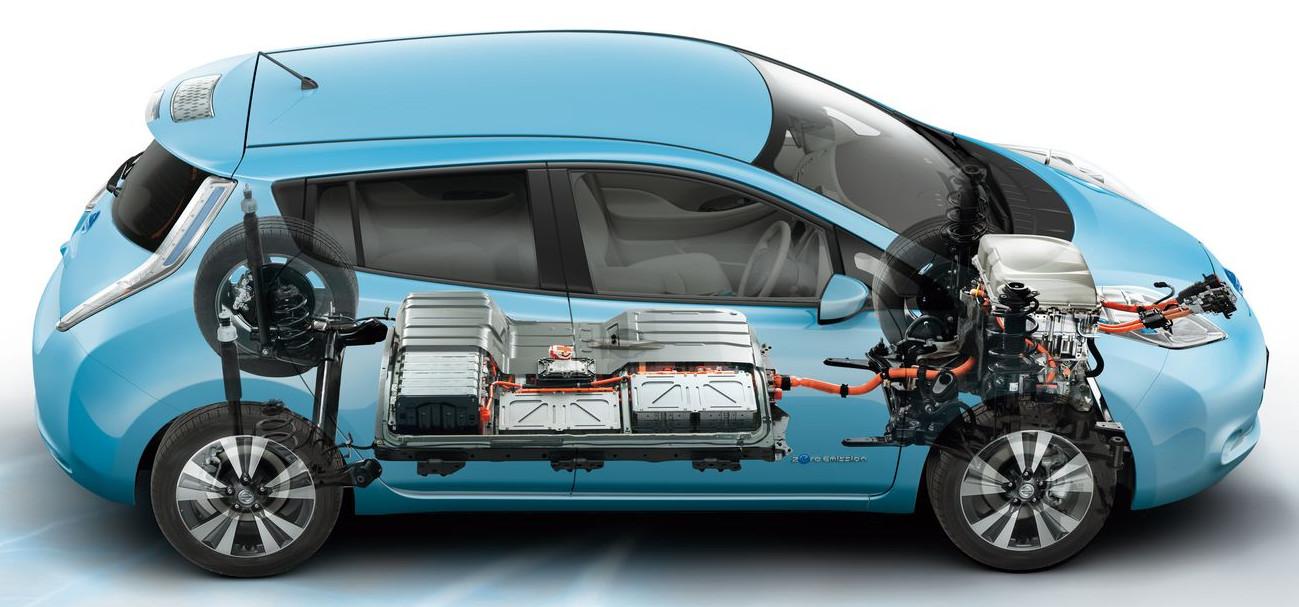

The Global Electric Vehicle Plastics Market offers significant opportunities for plastic material suppliers as automakers continue transitioning their lineups to include battery-electric vehicles. Plastics play a crucial role in EVs, as they are used in various interior and exterior components that need to be lightweight yet durable. Some key plastic applications include internal and external trim parts, battery casings, electrical component housings, under-bonnet components, bumpers, and others. Plastics help reduce the overall weight of EVs, which aids in improving driving range. The growing environmental focus and stringent emission regulations have accelerated EV adoption in recent years.

The Global Electric Vehicle Plastics Market Size is estimated to be valued at US$ 4.09 BN in 2024 and is expected to exhibit a CAGR of 27.% over the forecast period 2024 to 2031.

Key Takeaways

Key players operating in the Global Electric Vehicle Plastics Market are LANXESS, INEOS Group, Celanese Corp., AGC Chemicals, EMS-Chemie Holding, Mitsubishi Engineering Plastics Corp., BASF SE, SABIC, LyondellBasell Industries Holdings B.V., Evonik Industries, Covestro AG, Dupont, Sumitomo Chemicals Co. Ltd., LG Chem, Asahi Kasei. Rapidly declining battery prices and improving charging infrastructure are fueling demand for electric vehicles. Automakers are aggressively expanding their EV portfolio and production capacities to transition away from internal combustion engines. Countries worldwide are introducing new policies and incentives to boost EV adoption to meet climate commitments.

The growing environmental concerns and stringent emission regulations are driving demand for electric vehicles globally. Many countries have set targets to ban new ICE vehicle sales and achieve 100% new vehicle electrification by 2030-2050, pushing automakers to accelerate their EV development plans. Consumers are also increasingly preferring EVs over conventional vehicles due to rising environmental awareness.

Automakers are expanding their presence in key EV markets like China, Europe, and North America through new production facilities and local sourcing. China remains the largest EV market globally with the biggest production and sale volumes. Europe is also intensifying its focus on EV transition and domestic battery manufacturing to meet regional targets.

Market drivers

The key driver propelling the Global Electric Vehicle Plastics Market growth is the increasing EV production volumes worldwide to meet climate goals. Automakers are heavily investing in EV development and manufacturing capacity expansion. For instance, Volkswagen plans to build half a dozen battery cell plants in Europe with a total capacity of 240 GWh by 2030. Similarly, GM and Ford have committed billions towards EV infrastructure and bringing 30+ new models. This increasing automotive demand will require a strong supply of lightweight plastic components. Hence, plastic suppliers are well-positioned to capture opportunities in this high-growth market driven by decarbonization initiatives.

Current geopolitical uncertainties are impacting the growth of the global electric vehicle plastics market. The ongoing Russia-Ukraine conflict and rising tensions between China and Taiwan has disrupted supply chains and increased raw material costs globally. This has constrained the production and sales of electric vehicles in major automotive manufacturing hubs like Europe and China in 2022. Automakers are facing component shortages due to sanctions on Russia and export controls imposed by various countries. The supply of critical raw materials like lithium, cobalt, nickel used in EV batteries has been impacted. Higher energy costs in Europe post the war has also slowed EV adoption in the short-term.

Get More Insights On This Topic: Global Electric Vehicle Plastics Market

Explore More Related Topic: Global Electric Vehicle Plastics Market