Stratview Research has published a new report on the Commercial Aircraft Lavatory System Market, segmented by Aircraft Type (Narrow-Body Aircraft, Wide-Body Aircraft, and Very Large Body Aircraft), by Platform Type (B737, B777, B787, A320 Family, A330/A340, A350XWB, A380, B737 Max, B777x, A320 neo, A330neo, C919, and Others), by Lavatory Type (Standard Lavatory, Modular Lavatory, and Customized Lavatory), by Toilet Type (Recirculating Toilet System and Vacuum Toilet System), by Fit Type (Line Fit and Retrofit), and by Region (North America, Europe, Asia-Pacific, and Rest of the World). This report provides critical insights into the market dynamics and enables strategic decision-making for the existing and new market players.

Market Highlights

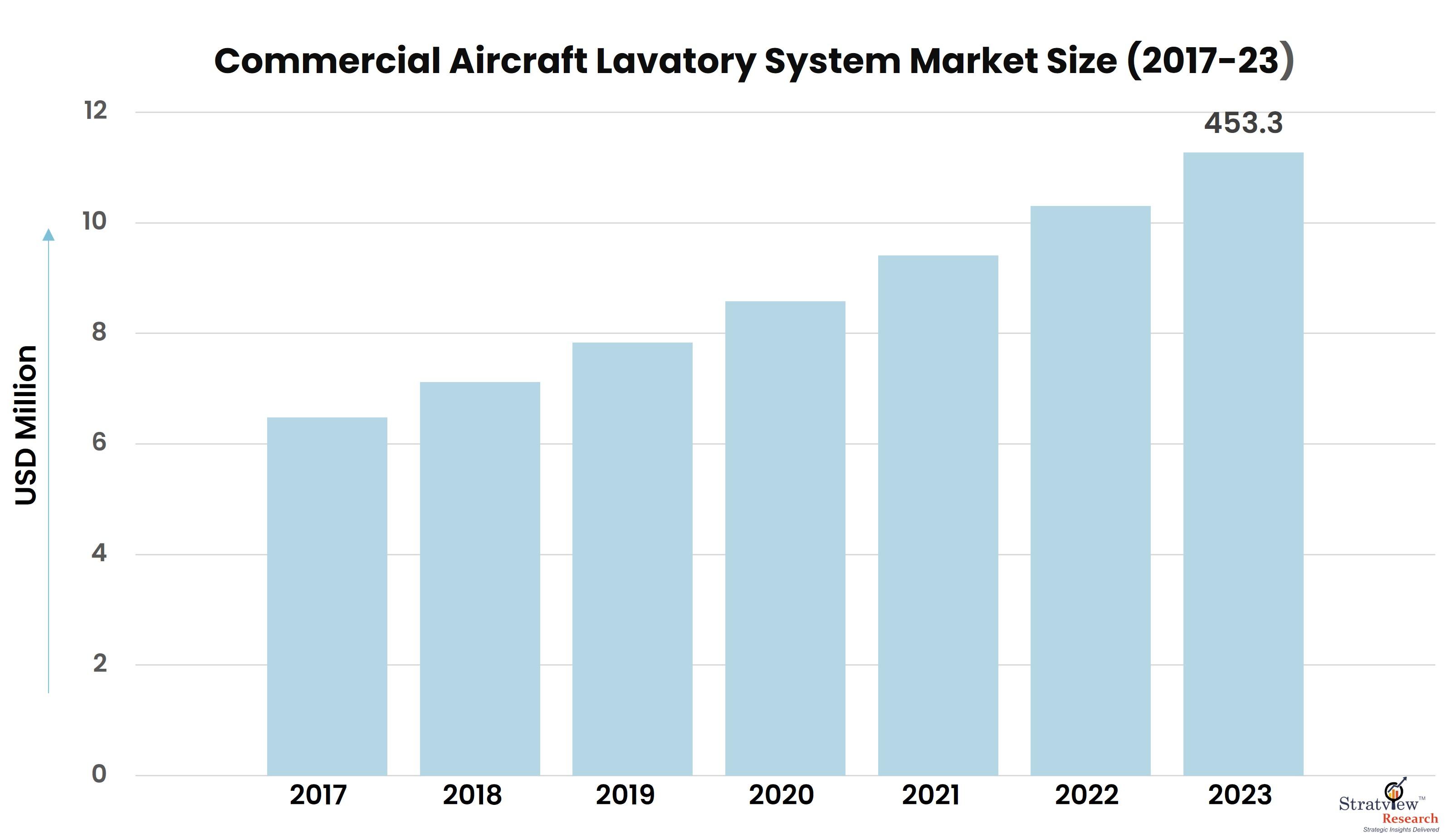

The commercial aircraft lavatory system market offers a healthy growth opportunity over the next five years to reach an estimated value of US$ 453.3 million in 2023.

Increasing commercial aircraft deliveries to support rising passenger and freight traffic, the introduction of fuel-efficient variants of major aircraft programs (B737 Max and A320neo), an advancement in lavatory design, and growing aircraft fleet size are the key factors that are driving the demand for lavatory systems in the commercial aircraft industry. Commercial aircraft is the biggest procurer of lavatory systems in the aircraft industry.

The lavatory is one of the most important systems in an aircraft cabin interior and must withstand high velocities and abrasion without spilling a drop. It should also be durable and minimize water usage to make the plane lighter for higher fuel efficiency and can withstand frequent usage by the passengers. The lavatory design varies from aircraft to aircraft and airline to airline depending upon their requirements. Lavatory manufacturers have gradually improved their design, making it lightweight using advanced materials. They have also shrunk the lavatory size without sacrificing passenger comfort.

Segmentation –

This report studies the Commercial Aircraft Lavatory System Market and has segmented the market in a few ways, keeping in mind the concentration of all the stakeholders across the value chain. Following are the ways in which the market has been segmented in the report:

The commercial aircraft lavatory system market is segmented based on the aircraft type as Narrow-Body Aircraft, Wide-Body Aircraft, and Very Large Body Aircraft. Wide-body aircraft is projected to remain the largest aircraft segment of the market during the forecast period, driven by increasing production rates of B787 and A350XWB, upcoming fuel-efficient variants including B777x and A330neo, and advancement in lavatory technology. Narrow-body aircraft are also likely to witness healthy growth during the forecast period, driven by the introduction of fuel-efficient variants of the best-selling aircraft programs (A320neo and B737 Max).

Based on the toilet type, the market is segmented as Reusable Toilet Systems, Recirculating Toilet Systems, and Vacuum Toilet Systems. There has been a continuous shift from recirculating toilet systems to vacuum toilet systems in all the next-generation aircraft. Vacuum flush toilets are considered to be less odor-inducing and usually light in weight which helps in saving fuel by reducing the need to carry large reserves of blue recirculating water and minimizing the risk of Blue Ice due to the spilling of water. Major lavatory manufacturers are developing advanced vacuum toilet-based lavatory systems by making them lighter in weight using composite materials. It will reduce the overall maintenance cost and remove waste rapidly during the flush cycle.

The overall competition is fierce in the commercial aircraft lavatory system market with half a dozen companies extending their offerings in this market space. All of them are trying to develop advanced and modular lavatories meeting OEMs’ and airlines’ needs. In 2013, B/E Aerospace (now a part of Rockwell Collins, Inc.) developed an advanced lavatory system for B737 which is slightly more compact than the standard 3X3 foot size lavatory.

Based on the regions, North America is expected to remain the largest market for lavatory systems in the commercial aircraft industry. The region is the manufacturing hub of the major commercial aircraft manufacturer, tier players, and raw material suppliers. Boeing is the largest procurer of lavatory systems in the region. Asia-Pacific is likely to be the fastest-growing market during the forecast period, driven by a host of factors including the opening of assembly plants of Boeing and Airbus in China, increasing demand for commercial aircraft to support rising passenger traffic, and indigenous development of commercial and regional aircraft (COMAC C919 and Mitsubishi MRJ).

About Stratview Research-

Stratview Research is a global market intelligence firm having a strong team of industry veterans and research analysts. Stratview Research has been serving multiple clients across a wide array of industries. Our services cover a broad spectrum of industries including but not limited to Energy Chemicals, Advanced Materials, Automotive, and Aerospace. At Stratview, we believe in building long-term relations with our clients.

Connect with our team here–

https://www.stratviewresearch.com/contact

Or

Call us @: +1-313-307-4176