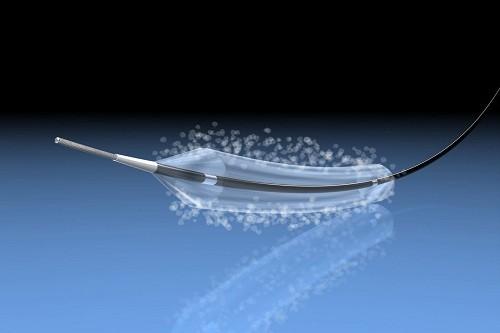

Drug eluting balloons are used in angioplasty procedures to open blocked arteries and treat peripheral arterial diseases. They are coated with an anti-proliferative drug, usually paclitaxel, to prevent renarrowing of arteries post procedure. Their use has significantly reduced major adverse limb events and repeat revascularization compared to uncoated balloons.

The global drug eluting balloon market is estimated to be valued at US$ 667.78 Mn in 2023 and is expected to exhibit a CAGR of 13% over the forecast period 2023 to 2030, as highlighted in a new report published by Coherent Market Insights.

Market Dynamics:

The rising prevalence of cardiovascular diseases (CVD) is one of the key drivers boosting the drug eluting balloon market growth. According to the World Health Organization, cardiovascular diseases are the number one cause of death globally, taking an estimated 17.9 million lives each year. Peripheral artery disease, a type of CVD, afflicts over 200 million people worldwide. Drug eluting balloons are commonly used for treating stenotic lesions in the superficial femoral and popliteal arteries in patients with PAD.

The increasing preference for minimally invasive angiography procedures over traditional open surgeries is another factor fueling the demand for drug eluting balloons. When compared to bare metal angioplasty, angioplasty with drug eluting balloons have shown lower rates of target lesion revascularization and prevention of renarrowing of arteries. These advantages make them an attractive option for both patients and healthcare payers.

SWOT Analysis

Strength: Drug eluting balloon is a minimally invasive treatment for peripheral arterial disease (PAD) that reduces blockages in arteries outside of the heart. This has advantages over other treatments such as bypass surgery and angioplasty as it is less traumatic, has a shorter recovery time, and reduces complications. With enhanced efficacy compared to standard angioplasty balloons, drug eluting balloons are gaining more popularity among physicians.

Weakness: Drug eluting balloons are more expensive than standard angioplasty balloons. There is also a possibility of systemic drug toxicity as a small amount of drug may enter the circulation during treatment. Approvals for new indications may take some time due to stringent regulatory processes.

Opportunity: Increase in geriatric population vulnerable to PAD represents an opportunity to expand the patient pool. There is also scope to develop biodegradable polymer-coated drug eluting balloons to reduce systemic drug absorption. Approval for treating smaller limb vessels and renal arteries can boost the market.

Threats: Stiff competition from alternative treatments limits market penetration. Reimbursement issues also restrict the widespread adoption of drug coated balloons. Long-term safety and efficacy data are still evolving which deter physicians from choosing this over conventional methods.

Key Takeaways

The global drug eluting balloon market size is expected to witness high growth over the forecast period of 2023 to 2030. The growing geriatric population afflicted by peripheral artery diseases is a key factor driving demand. As per estimates, the over 65 population is projected to surge from 727 million in 2020 to over 1.5 billion by 2050. This expanding patient pool represents significant opportunities for drug coated balloon manufacturers.

Regional analysis indicates that North America currently dominates the market, accounting for over 35% revenue share in 2023. Strong government support for clinical trials and availability of advanced healthcare infrastructure have facilitated early adoption of new technologies in the region. However, Asia Pacific is emerging as the fastest growing market, aided by rising healthcare expenditures, increasing incidence of PAD, and improving access to quality care.

Key players operating in the drug eluting balloon market are Cato Manufacturing Ltd, Culver Props, Inc., Delta Electronics, Inc., Dowty Circuits Limited, Hartzell Propeller, Inc., McCauley Propeller Systems, Inc., Sensenich Propeller Service, Inc., and others. Major players are investing in R&D to develop novel drug delivery technologies and biodegradable polymers to overcome current limitations. They are also expanding geographically through collaborations with local partners.

Get more insights on this topic: https://www.newswirestats.com/drug-eluting-balloon-market-size-and-outlook-2023-2030/