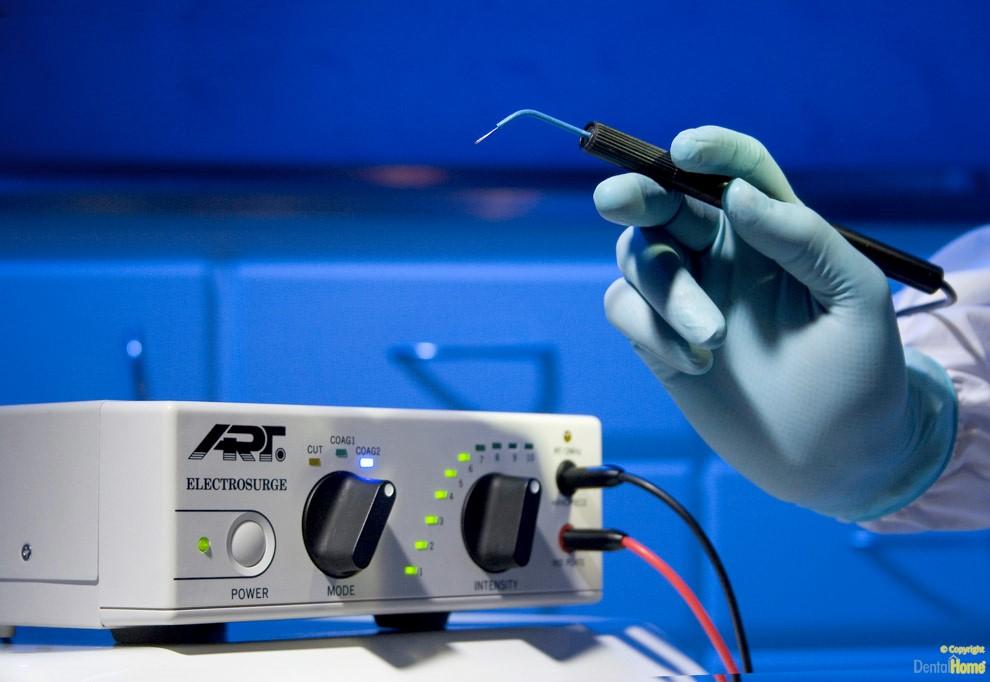

Electrosurgical devices are medical equipment used for performing surgical procedures such as ablation, coagulation, and cutting of body tissues while limiting blood loss. These devices operate using high-frequency alternating current that is used to cut, coagulate, desiccate, and fulgurate tissues. There is an increase in demand for electrosurgical generators and RF generators that can deliver a range of power settings and precise energy delivery for controlled heating of tissue during open, laparoscopic, and endoscopic procedures. With the increasing number of cosmetic and bariatric surgeries, there is a rising adoption of electrosurgical devices in India.

The global India Electrosurgical Devices Market is estimated to be valued at US$ 264.91 Mn in 2023 and is expected to exhibit a CAGR of 2.4% over the forecast period 2023 to 2031, as highlighted in a new report published by Coherent Market Insights.

Market Dynamics:

As mentioned earlier, the rising number of cosmetic and bariatric surgeries is one of the major drivers fueling the growth of India electrosurgical devices market. There is an increase in awareness regarding aesthetic appearance and obesity problems leading to a rise in surgical procedures in both private and government hospitals. Also, bariatric surgeries are gaining acceptance for effective weight management. This growing number of cosmetic and weight loss surgeries necessitates the demand for advanced electrosurgical instruments. Additionally, technological advancements in electrosurgical devices with features such as adjustable power controls, advanced coagulation modes for improved patient safety and outcomes are augmenting their adoption rate among healthcare facilities.

SWOT Analysis

Strength: India has a large population and growing middle class which leads to an increasing demand for electrosurgical devices. The market is expected to witness growth due to rising cases of cancer and chronic diseases that require surgical treatments. Government initiatives to improve healthcare infrastructure will boost the adoption of advanced electrosurgical technologies.

Weakness: Lack of proper reimbursement policies is a challenge for patients to afford expensive electrosurgical procedures. Rising prices of electrosurgical devices puts financial burden on hospitals as well as patients. Shortage of skilled medical professionals limits the widespread use of electrosurgical devices.

Opportunity: Increasing medical tourism and rising healthcare expenditure provides an opportunity for companies to expand their customer base and promote new electrosurgical products. Growing number of hospitals and surgical centers present a platform to introduce advanced electrosurgical generators and accessories.

Threats: High import duties on medical devices increase the overall cost of electrosurgical systems. Strong competition from local and international players poses pricing pressure on established brands. Stringent regulatory approvals and quality standards from regulatory bodies delay new product launches.

Key Takeaways

The India Electrosurgical Devices Market Share is expected to witness high over the forecast period owing to rapidly growing geriatric population, rising prevalence of chronic diseases, and improving healthcare infrastructure in the country. The Indian government has undertaken various initiatives such as expanding health insurance coverage and increasing healthcare spending that will boost the demand for electrosurgical procedures. The global India Electrosurgical Devices Market is estimated to be valued at US$ 264.91 Mn in 2023 and is expected to exhibit a CAGR of 2.4% over the forecast period 2023 to 2031.

Regional analysis:

The electrosurgical devices market in India is dominated by the western region with states such as Maharashtra and Gujarat having well-developed healthcare infrastructure and higher preference for elective surgeries. Southern states including Karnataka, Tamil Nadu, Andhra Pradesh, and Telangana also capture significant market share due to increasing health awareness and availability of quality surgical care at affordable prices. Rising medical tourism in north Indian states provides lucrative opportunities for electrosurgical device manufacturers to tap an emerging patient base from neighboring countries.

Key players:

Key players operating in the India Electrosurgical Devices Market are First Care Products, TyTek Group., PerSys Medical, IBC, and H&H Medical Corporation. First Care Products has a well-established distribution network across India for its diversified product portfolio of electrosurgical generators and accessories. TyTek Group specializes in manufacturing bipolar and monopolar electrosurgical forceps catering to various surgical specialties.

Get more insights on this topic: https://www.newswirestats.com/india-electrosurgical-devices-market-size-and-share-analysis-growth-trends-and-forecasts/